Table of Content

Team BankBazaar February 7, 2017Hi Raj, Every lending firm has its own rules regarding part payment. You might have to wait to prepay your loan if it is in the terms and conditions of the loan as stated by your lender. To ensure that prepaying a loan works to your advantage, keep your EMIs unchanged.

You would have considerably fewer savings via Dave Ramsey's method than if instead, you followed Ric Edelman. The money within your home will be very hard to tap, and you could wind up foreclosing on your home anyway. This is the exact issue Dave Ramsey is suggesting you avoid by eliminating your debt. This proves my point of cash flow is more important than net worth.

FHA Refi and Purchase Loans

If you are paying something monthly, you don’t have the lump sum being with. My desire is to build my various investments to the point where I will earn enough to replace my income and lower my tax rate cause we all know investments are taxed at lower rates. But if you push away the fear you will see the lender is giving you money at 3% after deductions that historically returns 7% in the market. But, you took on risk when you bought the property in the first place. Way too many folks on here with comments like I feel like or I’m scared to.

But in a home this is generally even better than almost any other taxable investment. But you also pay no taxes on your home sale even if the value goes up. And effectively that interest rate gain you get also incurs no tax. In some cases, these expenses increased much more than the average rate of inflation. For example, where I currently live, Nassau County, NY, I pay almost $10,000 annually for a 2,000-square-foot residence. Let me remind readers that Nassau County is broke, and more than likely will have to raise taxes even higher to meet its budget gap.

Should I pay off my mortgage early?

There’s no way I’m paying extra on my principal…especially when I plan on moving in 5 years. Nevertheless, I think the main benefit of paying down your mortgage is peace of mind, and of course, if you have a high interest rate. There are many articles similar to this, indicating that since money is cheap, hold on to your mortgage forever and throw everything else into the stock market. The stock market might earn 7-8 percent, but you are also assuming that people will put all extra into the market without fail or that the U.S doesn’t have a lost decade or similar to Japan.

She would have a $100,000 in capital gains and would be under the $250k limit you mentioned. Capital gains taxes are extremely low at 15% for the long-term outside of retirement accounts. So the savings should most definitely go into tax deferred accounts first.

Should you worry about a mortgage prepayment penalty?

+ This also implies that 100% of your income is captured by the incremental mortgage payment if you go with shorter term. Depending on income and financial savvy-ness, people probably are also investing in stocks and some bonds as part of their PA or IRA. Some further exposure to real estate (i.e. accumulating equity in your home) isn’t wholly bad – especially when stock markets are hot.

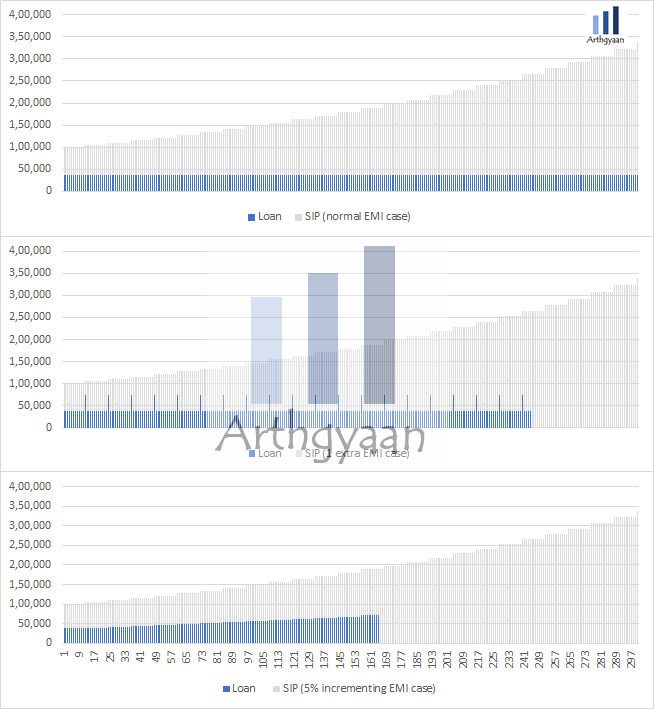

What I am saying is that you should try to prepay your loan through your regular income. In both cases, if I am comfortably paying the EMI, I will not prepay the loan. I will use this surplus/windfall to jumpstart my investment. I will try to prepay the loan, but not through this surplus. I will prepay it through my regular income from time to time.

Should I Prepay My Mortgage or Refinance? Calculator

You are getting more than , by way of rent payment ,you are putting only 4000 into RD. This is a gesture of thanks and also to help the demand supply mismatch, as explained earlier. Now the assessment of values as at the end of 120 months.

I think the above calculations did not consider the growth of interest saved as an investment. Prepayment only up to get befefit of 1.5 lacs intrest deduction in tax and and rest amaunt we sholud invest in PPF ( 8.8% tax free). I don’t have much knowledge about what happens when we pre-pay the home loan so correct me if my direction is wrong. Investments in PPF, tax free bonds and long term equity MF are not taxable as of today. We are looking for live cases and how things look for people who have some amount that can be used for downpayment.

You’re investing your savings in another property? I lived in the North Bay for 25 years, so I’ve seen the rent go from $570 on a 2 bedroom apt to over $1700. The apt I rented in 2009 was $825, and it’s now $1625. The rent has increased $100 every single year. Prior to living in that apt, in 05 I rented a house. The owners bought a second house to live in because”the first one wasn’t big enough” smh.

With each passing month’s EMI, the interest paid decreases and the principal repaid increases. Do spend some time studying the earlier table. I didn’t do any detailed calculation but my logic behind prepayment was if I invest in FD of 9.5%, I’d be getting around 7-7.5% after tax. My home loan interest rate is more than that so better pay off the loan.

Well you forget 1 thing, Due to the tax changes coming for next year it is a VERY good idea to prepay as many house payments as possible this year if you currently itemize deductions. You will be able to deduct the prepaid interest this year. Many people that itemize now will not in the future due to the change of the 12,000 to 24,000 standard deduction that is coming.

The investor in all stocks could be down 40% or more. The early payer can catch up quite quickly when stocks on on sales. While the other needs the market to almost double to be back to where he/she was.

In fact, it could be the crown jewel of a structured, effective financial plan. Perhaps most important is that paying it off early is a guaranteed way to save money -- possibly a considerable amount. Now the second half of the loan tenure will be comfortable.

No comments:

Post a Comment